How to Select the Right Hard Money Lenders in Georgia Atlanta for Your Investment Needs

How to Select the Right Hard Money Lenders in Georgia Atlanta for Your Investment Needs

Blog Article

The Advantages of Choosing Cash Lenders genuine Estate Investments

In the world of actual estate financial investments, choosing the ideal financing source can significantly influence an investor's success. Cash lending institutions supply distinctive benefits, such as expedited access to funds and tailored lending options that provide to specific monetary situations.

Faster Accessibility to Funds

In the affordable landscape of genuine estate investing, time is frequently essential, making quicker accessibility to funds an essential benefit. Financiers frequently run into chances that require prompt monetary commitment, such as public auctions or distressed home sales, where delays can bring about missed chances. Cash lenders, especially exclusive lending institutions and difficult cash loan providers, can provide expedited loan procedures that traditional financial institutions typically can not match.

Generally, these lending institutions improve their application and authorization procedures, concentrating much less on comprehensive documentation and even more on the possible worth of the home. This shift allows capitalists to safeguard funds in an issue of days, as opposed to weeks or months. Furthermore, cash loan providers usually have a higher desire to assess the building's equity as opposed to the customer's credit report, additional increasing the funding process.

Moreover, the capacity to access funds rapidly equips capitalists to act emphatically, enhancing their one-upmanship in a fast-paced market. This agility not only facilitates quick deals yet can additionally lead to much more positive acquisition rates, as customers can offer immediate cash offers. Ultimately, faster access to funds is an important element for success in the dynamic world of property investing.

Versatile Finance Alternatives

Supplying a selection of loan structures, cash lending institutions deal with the varied demands of actual estate capitalists. Unlike standard financial institutions, which may impose rigid lending criteria, cash lending institutions supply versatile alternatives that can be tailored to certain investment techniques. This versatility enables investors to select from numerous loan kinds, consisting of short-term bridge car loans, long-lasting financing, and also interest-only finances, depending upon their project needs.

In addition, money lenders often supply adjustable terms, enabling capitalists to discuss repayment timetables, rates of interest, and loan quantities that align with their economic goals - hard money lenders in georgia atlanta. This adaptability is especially advantageous for capitalists that might come across distinct scenarios, such as rapid market adjustments or particular residential or commercial property kinds that require specialized financing

Furthermore, cash lenders often assess the capacity of the financial investment home itself as opposed to the debtor's credit history alone, allowing experienced investors and beginners alike to confiscate opportunities that may or else be unattainable. By providing a variety of loan choices, cash lending institutions empower investor to make strategic decisions, consequently boosting their capacity to grow their portfolios effectively and effectively.

Personalized Solution

Real estate financiers profit dramatically from the personalized service offered by cash lending institutions, which establishes them apart from conventional banks. Unlike traditional financial institutions, cash lending institutions often take the time to understand the distinct situations and goals of each financier. This tailored method enables them to supply tailored funding remedies that straighten with the capitalist's details demands.

Cash lending institutions commonly have a more flexible decision-making procedure, allowing them to respond promptly to demands and adapt to changing market problems. This agility is specifically critical in the hectic realty setting, where chances can occur and call for instant action. By constructing a strong rapport with their customers, money lending institutions can provide understandings and recommendations that are useful for making informed financial investment decisions.

Additionally, the customized solution prolongs past funding approval. Money lending institutions typically provide continuous support throughout the life of the investment, aiding clients with refinancing alternatives or additional financing as required. This level of interest fosters long-lasting relationships, producing a collaboration that benefits both celebrations. Inevitably, the customized solution offered by money lending institutions enhances the property financial investment experience, paving the method for effective end results.

Less Rigid Needs

Cash loan providers often prioritize the building's prospective value and the financier's experience over strict debt evaluations. This indicates that individuals with less-than-perfect credit report or those that are brand-new to realty investing may still protect financing. Furthermore, the documents process is generally streamlined, enabling faster authorizations and reduced waiting times.

These much less rigid requirements allow more investors to get in the market and seek opportunities that might or else run out reach. By concentrating on the values of the financial investment and the customer's intent, money lending institutions assist in an even more comprehensive financing opportunity, cultivating growth in the realty industry. This permits capitalists to maximize opportunities promptly, enhancing their chances of success in a competitive landscape.

Competitive Rate Of Interest

While standard lending institutions often worry customers with high rates of interest, cash loan providers frequently give affordable rates that can dramatically my sources profit genuine estate investors. This benefit is especially important in an atmosphere where investment margins are often tight and cash money circulation is a main problem for homeowner.

Cash loan providers commonly run with better versatility than traditional financial institutions, enabling them to supply tailored funding products that my review here straighten with the particular requirements of actual estate projects - hard money lenders in georgia atlanta. Their competitive rate of interest might be less than those offered with standard financial establishments, allowing capitalists to maximize their returns. Additionally, the transparency related to money lending institutions typically indicates less concealed charges and charges, permitting financiers to accurately determine the total expense of borrowing.

Additionally, the capacity to secure car loans swiftly can be a crucial consider real estate financial investments. Money lenders give expedited funding remedies, which can be important in taking advantage of on time-sensitive opportunities, such as distressed buildings or competitive bidding scenarios. Therefore, the combination of competitive rate of interest prices and swift access to capital placements money loan providers as an eye-catching alternative for savvy real estate investors looking for to optimize their economic methods.

Conclusion

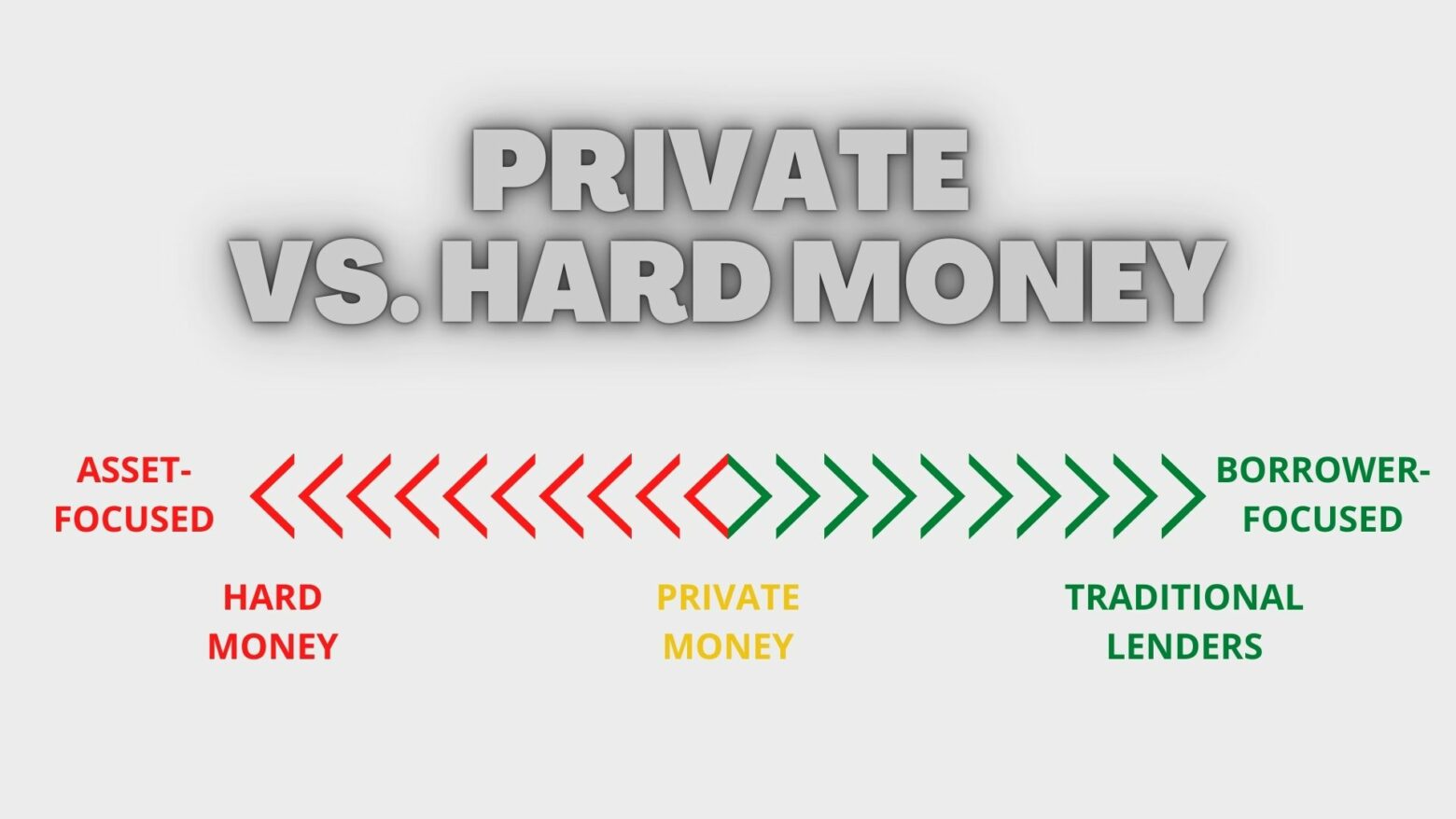

Money lenders, specifically personal lenders and hard cash lenders, can provide expedited loan procedures that conventional banks usually can not match.

Using a variety of loan frameworks, money lending institutions cater to the varied needs of genuine estate capitalists.Genuine estate capitalists benefit significantly from the individualized service given by money lending institutions, which sets them apart from typical financial establishments. Thus, the mix of competitive rate of interest prices and quick accessibility to capital placements money loan providers as an eye-catching option for wise real estate financiers looking for to enhance their economic strategies.

In final thought, picking money loan providers for actual estate investments provides countless advantages that can considerably profit capitalists.

Report this page